Your Credit Score

One of the essential requirements for earning credit card rewards points from signup bonuses is tracking and maintaining a good credit score (usually over 700 to get approved for the premium travel cards). But how does one go about doing this?

We recommend using the FREE app from the Experian credit bureau. Per their site, “View your Experian Credit Report and FICO® Score any time, anywhere on your phone or tablet,” plus get credit monitoring alerts. You previously had to pay each time you wanted your actual credit score, so it’s hard to beat this new and improved service!

Will the opening of credit cards destroy your all-important credit score?

The short answer is, no. Over time your credit score should remain roughly the same or even improve. But in the short-term you likely will see a dip in your credit score. This is why, if you plan to apply for a big loan in the near future, now is not the right time for you to get started with this strategy.

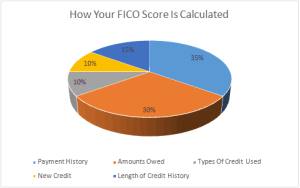

To understand why the long-term impact of this strategy is positive but the short term is negative, let’s look at the factors that contribute to your credit score.

Low Impact Factors:

- Total accounts: The more the better. The fact that multiple creditors give you accounts means that you are credit worthy in the creditors eyes. Obviously as your pile of credit cards thickens your grade will get better in this category. (Verdict: Yay)

- Credit inquiries: The more the worse. When you apply for six credit cards in one day, Your behavior makes you look a bit like Nicholas Cage in Leaving Las Vegas. “More credit cards equals more whiskey. ” You just don’t give a damn. It is estimated that each hard inquiry on your credit report costs you 5 to 7 points on your credit score. Fortunately this phenomenon is short-lived. With minimal effect on your credit score after 2 to 3 months. (Verdict: Boo.)

Medium Impact Factors:

- Age of credit history. (It’s going down.) Each time you apply for and get six credit cards, You’ve added six credit cards with the age of zero to your credit history. As you might imagine your credit history’s age can shrink pretty quickly. The longer you’re in this game, the less effect this will have. But make no mistake on this front; you’ll take a step backwards. (Verdict: Boo)

High Impact Factors:

- Derogatory marks: The worst thing you can do for your credit score is to not pay your bills on time, to default on a loan, or to declare bankruptcy. But you’re never going to be late on a credit card payment, you will keep track of your cards, and pay off your bills as soon as they arrive. Right? (Verdict: Ambivalence.)

- Credit card utilization: This is the one that makes everything alright. You see, creditors want you to use a bit, but not much of your credit line. When it comes to credit card utilization, you will look very unlike Nicholas Cage drunkenly stumbling through a casino. You will look more like a Vanderbilt; lots of assets, and not many bills.

Of course, there are no guarantees. The formula for credit scores could change, your experience could be different from ours. It is (of course) up to you to monitor your scores and weigh the risks and benefits of this strategy.

Personal Decision Point

You need to determine your own comfort level with minor credit score fluctuations before getting started. For most of us with excellent credit ratings, a few points up or down won’t impact much of anything.

This is especially true if you aren’t looking to make a major purchase on credit (mortgage or car) in the near future. As we’ve described above, this won’t have a major impact on your score, but it is still a best practice to not open a significant number of credit cards in the ~12-18 months leading up to a home (or, to a lesser extent, car) purchase.

When Brad and I each independently embarked on this journey we determined for our own lives that we had some risk tolerance for a credit score drop if it meant earning a significant amount of free travel for our families. That we haven’t experienced a drop at all (other than temporary fluctuations) makes it all the better.

Action Step:

As today’s ‘action step, we ask you to consider your own life and your risk tolerance for this fluctuation and answer this question: Is now a good time for you to get into travel rewards?